original: April 7, 2010

i just want to point out that a chinese dollar, aka yuan, aka renminbi, moved from about 8:$1US in 2007 to about 7:$1US in 2009. That’s more than 10% accumulation, right? (making it easier for them to buy our stuff, and harder to sell stuff to us; keep in mind, seems like most economists want to promote out export industries by reducing the worth of our money compared to theirs, while they are trying to keep their money worthless compared to ours so they can keep selling us so much stuff for so cheap because at least it keeps them employed… i wish i was just making this up in some sci-fi social criticism fantasy… remind me again why we don’t live in a world where all countries want their money (and by extension, hours of labor, at least when buying imports) to be worth the most???)

in 2006, $1US peaked at .85euros, dropped until July 2008 to .65euros (about where the charts below start), rose back to .8euros until October, while the US markets slacked, jumping with the final cliff drop(s) of the stock markets, (bouncing before) dropping while they surged, and now surging while they surge. Sorry if that seems unclear, but i’ve been trying to reclarify for myself if there is any correlation. Did the last 2 years hit all 4 logical possibilities of TT,TF,FT,FF?

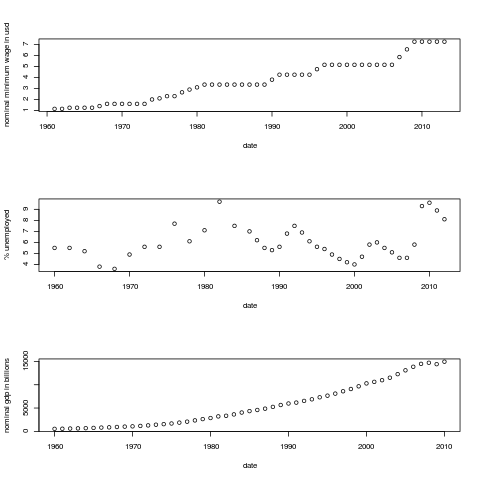

x-axis:4/08-4/10

y-axis:.62-.80

x-axis:4/08-4/10

y-axis:6k-14k

Oh wait, I think we’re only missing down and down. Which I suppose should mean that a contrarian would want to buy euros?

| usd/eur |

djia |

time |

| up |

down |

2008q2-3 |

| down |

up |

2009 |

| up |

up |

2010q1 |

or at least last spring, trying to make sense out of what was happening, i read a number of traditional economic summaries on the inverse relationship of inflation and unemployment. how can prices go up when people don’t have jobs? on the other hand, when there’s more money around, each piece of it has to be worth less, right? So it seemed reasonable that the dollar bounced during the worst drops of 2008-09, and then sagged as the market recovered since 3/09. some bloggers had been referring to the dollar as a “safe haven”, but that logic can seem a little backwards in an economic collapse, and seems unnecessary given the basic supply-demand logic above. though i suppose i would be in error to exclude any of these highly inter-related factors in such a psychological game.

the same reasoning basically applies to gold. if its value was primarily that of a safe haven, we’d expect moves inverse to the market, assuming more people will try to hide in safe havens during bad times. In fact, 11/08-4/09 seems to show that sort of pattern. however, since then, at least until this year, gld has seemed to follow the same basic money supply-demand logic: prices rise as the dollar loses value (looking at the euro below). but this year, the market, gld, eur/usd have all been rising together! could have something to do with EU debt woes. of course, considering the pound and the yen complicates things a bit (their 2-year charts are inserted at the end, for reference, though I am gonna have to figure out something about this piss poor resolution).

x-axis:4/08-4/10

y-axis:-50%-+40%

from yahoo finance (blue=usd/eur, red=djia, green=gld)

anyways, a dollar is currently near .75euros, so skipping the wild swings in the middle, it’s near the same change as the yuan (in the opposite direction). if china is keeping the value of its yuan artificially low, it’s pretty much also keeping the value of a USD artificially high. are china bashers implying that 10% losses in the value of the dollar aren’t good enough? would they like to see us lose 20, 30, 50%? and presumably that would look great on stock market numbers, but what good would the dow breaking 20,000 be, if it took a wheel barrow of money to buy a loaf of bread?

at least we climbed .5 to .65 against the GBP from summer 2008 to the start of 2009.

since 2007, the USD has dropped from 120 to 90 JPY, which is a damn lot, and apparently what we want from the Chinese too, except isn’t that just because the japanese economy hasn’t seen growth for some 20 years. (i’d like to think that shouldn’t even be a problem since they’ve renounced the excessive fertility of undeveloped countries).

anyways, i’m just sick of hearing supposedly “liberal” economists like krugman jumping on this china bashing band wagon, as if 20% swings in the values of a major economy’s currency within a year’s time were something desirable, and that a 10% accumulation in value over a couple of years wasn’t an intelligent strategy. I was planning to bash stiglitz on this too, but surfing his recent comments brings up a lot of “china is doing the right thing” hits. no shit. if this is their strategy, i just hope our leaders are coming up with something more sophisticated than blaming them for our stupidity. shit, when did we trade strategies?

of course, that’s said little about the gap between the rich and the poor, and i will try to look into some more data about how that’s changed in various regions over the last few years. we talk about inflation or deflation, just as population increases and decreases, since anything but stability is bad, since even if stability is bad, instability is usually worse.

—–

jpy/usd:04/08-04/10

gbp/usd:04/08-04/10

actually the real problem with all these comparisons is that though i just read an article the other day claiming that these were the only currencies even relatively secure enough to be considered candidates for international trade, it’s not just the euro that’s plagued by phobias about lazy mediterraneans or the dollar propped by rich asians who don’t know what else to do with their money; the economies of japan and britain already had leaky reputations and were practically on life support before the global fiasco of the gambling bank bailouts even began. still it’s really hard to tell if there’s actually a problem because in many cases the currencies are gaining value but to read the capitalist blogs, they’d rather hear about rampant inflation at least insofar as that can be counted as “economic growth”.